15 Financial New Year Resolutions for 2023

If you haven't already thought about finances for 2023, here are some ideas for financial New Year resolutions to get you started.

How are your New Year’s resolutions going? Did you set any financial goals? If you haven’t already thought about finances for 2023, here are some ideas for financial New Year resolutions to get you started.

When it comes to achieving your financial goals, the same principles for success apply as they do for any other goal. Here at The Healthy Mummy we like SMART goals. If you’ve not heard of SMART goals before, here is a quick rundown.

What Are SMART Goals?

SMART is an acronym and the letters stand for:

Specific: Choose goals that are clear and specific. Avoid words like “better” or “more” as they are hard to define.

Measurable: You need to be able to measure success.

Achievable & action-orientated: That is, they include HOW you will achieve something.

Realistic: Choose realistic goals that stretch you but aren’t unachievable.

Time-based: Set a time limit or finish line on your goal.

An Example Of A SMART Financial Goal

If you’re wondering what a SMART goal might look like, here is an example of a SMART financial goal: I’m going to save $12 a week by cutting out my morning takeaway coffee three times a week for a year.

This goal is specific and measurable ($12 a week), action-orientated (skipping the takeaway coffee), realistic (three days a week rather than every day) and time-based (a year). By working with goals like this, you are not only more likely to achieve your goal, but you’ll also be better able to track your progress.

Ideas For Financial Goals

Now that you know how to set SMART goals, here are 15 ideas of financial goals you might like to set for the new year. Remember to personalise these financial goals for you and work out how to make them specific, measurable, action-based, realistic and time-based.

Ask yourself how you will achieve the financial goal, what you need to change, when you’ll do it and how you’ll measure your progress.

15 Financial New Year Resolutions

- Reduce the electricity/gas bill by x% by doing…

- Pay off $x of credit card/personal debt by doing…

- Bring in $x more income per week/fortnight/month by doing…

- Reduce your grocery budget by $x a week by doing…

- Check out phone and internet plans and change to the best deal.

- Save $x in the next month/quarter/year by doing… (sell off excess stuff, reduce specific expenses, cut out take away for a month etc etc)

- Start investing in shares or managed funds (how much, how often).

- Check on super balances and roll over/consolidate any excess accounts.

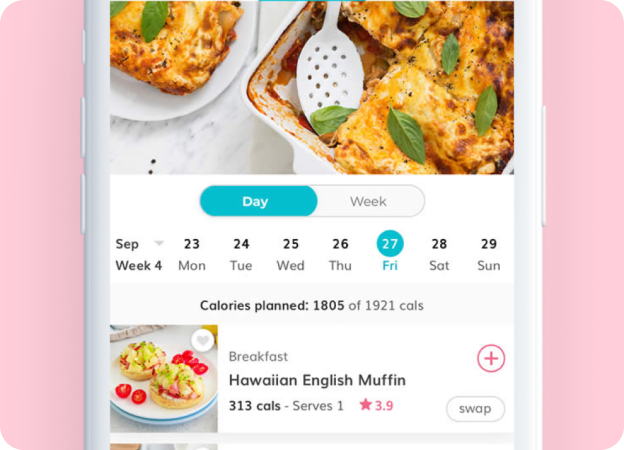

- Spend less on takeaway (how much less, how often will you cut back, how much will you save) – check out these fakeaway recipes

- Save $x for a family holiday (how, by when, be specific!)

- Pay an extra $x a week/month off the mortgage.

- Start a Christmas fund by putting away $x every week/fortnight/month.

- Track our family’s expenses for a month to see where the money goes.

- Review insurance premiums to see where we can save.

- Cut back on coffees/lunches out (how many, how often, what will you save)?

Once you have some goals to work towards, it’s time to be disciplined and follow through. If nothing changes, nothing changes!