7 secrets to better money management – hit your savings targets EASIER!

The Australian 2018-19 Budget has been announced and we have already outlined 6 ways the new Budget may impact your family.

With the budget on everyone’s mind, The Healthy Mummy team has reached out to Dylan Martin, Financial Advisor, of Feel So Good Wealth Management and dad of three for his BEST money management tips.

Here’s what he has got to say…

7 secrets to better money management – hit your savings targets EASIER!

If you want to enjoy life without the chains of your money holding you back, want to reduce stress and uncertainty around money and change your relationship with it, have a strong desire or distinct purpose to save or wish to become the best possible financial version of yourself…be sure to read on!

Step One – Acceptance & Awareness

It is important for us to acknowledge that budgets are NOT evil! Your budget helps you to put a specific target on what you want to spend money and what you have to spend money on. This is acceptance.

You need to understand what it costs to be you.

You are unique and individual. Averages and benchmarking to others like you (single, couple or young family) can be used as a helpful “measuring stick” of what a “decent lifestyle” is, but in the beginning, you need to identify financial habits or behaviours that could be acting as a roadblock to your goals and aspirations.

Step Two – Why guilt-free spending is great…

We may upset a few people here – but truth be told – some budget tips are simply terrible. You absolutely should be able to enjoy some of life’s little pleasures. Coffees, drinks with friends, Netflix, new activewear Healthy Mummies – the list goes on.

If those small items bring you joy you should not have to cut them out. Sure, you could save $800 a year by cutting out bought coffees. Being down and saving can be counterproductive leading to further unhappiness and loss of drive or motivation towards your saving goals. What’s the point otherwise?! Creating a separate and specific “guilt-free spending” bucket is a must.

This concept feeds into our idea of a great money management system.

Step Three – Always ask why

Why are you saving?

Take the time to sit down and ask yourself why you want to save money. What is your relationship with money like? Can you define it? Has your upbringing influenced your attitude towards money? Research shows that you are more likely to succeed in your saving targets if you have a strong reason or purpose to save. This may include your desire to be the best possible financial version of yourself.

Step Four – Goals vs Values

Goals and values are different and can conflict – I see this often when meeting with new clients.

Values are your fundamental beliefs, how you want to live life and why. These values are guiding principles that dictate behavior and action. A goal is a measurable target or something you would like to achieve with a specific timeframe.

A trip to Italy costing $12,000, in two years’ time, is a goal. Specific and measurable. Whereas, experiences and flexibility are core values. Saving for a home deposit is a goal. Comfort and security are core values.

The reason it is important to define your core values is to make sure that your goals are aligned with your values, otherwise, you may be no happier or satisfied in life by achieving some of your goals. For example, if you value freedom and new experiences, taking on a large mortgage that leaves you with minimal disposable income may impact your life satisfaction because your ability to fulfil a core value would be reduced.

Establishing value-centred goals can give us a greater purpose in life, separate the important from unimportant, drive us in a positive direction and often as goals change, values are consistent.

Step Five – Aligning your budget with your goals and values

Aligning your budget with your goals and values dramatically increases the likelihood of achieving future goals. An important part of this process is identifying whether current spending habits are stopping you from getting where you want to be.

In my role as an adviser, I never tell clients where to cut down their spending. Instead, we talk about “value”. You need to identify what brings you value. What in your life (represented by items in your spend budget) is bringing you joy and what isn’t.

It’s a valuable exercise that can help keep you stay accountable, reclaim more time, consume less and living a more intentional life.

Step Six – Get a better system…

Forget fancy products or the worlds best investments. Sound money management and positive financial habits and behaviours drive MOST of your financial independence.

A better banking and cash flow allocation structure will support good savings and spending habits and make it easier for you to achieve your saving targets. Using a single bank account is not an effective way to save.

We advocate separating your accounts into different purposes – guilt-free spending, fixed expenses, future fund, lifestyle fund – there are many variations of this – but the key is having an easy to understand system otherwise you are second-guessing what you can and can’t spend and it becomes overcomplex and ineffective.

Step Seven – Automation

There are industries devoted to making us spend money on things we don’t need. Not to mention an overload of information available to us on social media. We suggest automation of cash flow into your “buckets” to save time and reduce temptation, poor money choices and today’s ever-increasing decision fatigue.

Thanks for the great tips Dylan!

Want to save more money?

Here are 8 quick ways to cut your grocery bill this week.

To help you SAVE MONEY – we’ve pulled together EVERY single money saving tip we can get our hands on for saving, food shopping and lifestyle. Check it out here.

Be sure to also download our FREE Meal Prep Essentials Guide + Recipes.

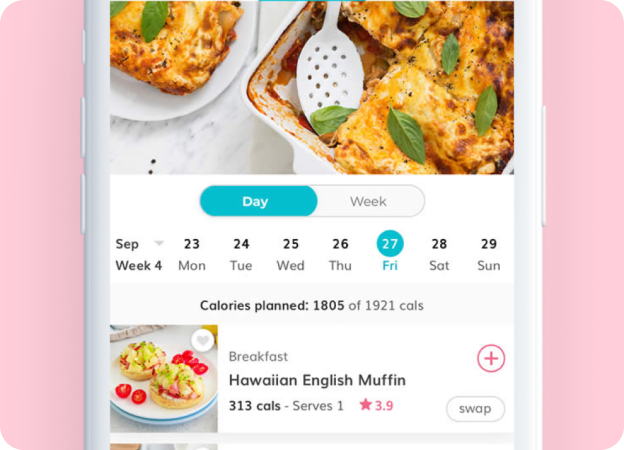

The Healthy Mummy’s 28 Day Weight Loss Challenge, weekly meal plans, recipes and exercises DESIGNED to help busy mums lose weight.