Practical Financial Advice and Tips from Effie Zahos

Financial expert Effie Zahos explains how to create a household budget that gets the bills paid and leaves some dollars for fun.

Effie Zahos is one of Australia’s leading personal finance commentators with more than two decades of experience in consumer finance topics, including banking, finance and property. She has a knack for making money matters simple. Effie shares her top budget tips and financial advice to get finance fit with The Healthy Mummy.

It’s never been a more expensive time to live! With another interest rate rise for mortgage holders, a rental crisis and expensive petrol, electricity and food, it really is a time for some practical financial top tips.

As the cost of living continues to rise, inflationary pressures are expected to persist for some time. Aussies are now looking for ways to take back control. The good news is that with a little planning, you can. As the saying goes, ‘you can’t control the wind, but you can adjust your sails.’ And the best tool you have when it comes to adjusting your sails is the humble household budget. Nobody really teaches you how to build a budget let alone manage one.

It’s expected that you just know how to do it. I actually cover the basics of budgeting in my book From Converse to Louboutins: A Real Girl’s Guide to Money. First, you need to look backwards before you can move forward. Print out your online bank statements and highlight your expenses.

What you’re looking for here is:

- Did you overspend in some categories?

- Do you need to review some of your household bills?

- Is your spending in line with your goals?

- Do you have too many discretionary “tap and go” purchases?

This should give you a good idea as to where your money is going. From here, you’ll be able to group your costs into a formula.

Set your formula

There’s no shortage of formulas to help you manage your budget, including paying your bills on time and being able to take those much-needed holidays. A popular option is the 70:20:10 plan. Here’s how it works. Divide your money between:

- 70% for everyday living costs (rent or home loan, transport, clothing, food and utilities).

- 20% for saving (don’t skimp on savings)

- 10% for splurging.

Next, set up some buckets. Instead of lumping your “everyday living” expenses into a single bucket, for instance, open multiple buckets (accounts) and give each of them a nickname. You might have one account for school fees, another for household bills and so on. The same goes for savings. The 20% can be further broken down between savings buckets – 5% can go to your rainy day bucket, 10% to your holiday bucket and 5% to the “get ahead” bucket.

Using buckets within buckets makes it easier to achieve multiple goals. You can allocate a set sum to each bucket, track your progress and fine-tune your budget for each target. Choose fee-free online savings accounts with a healthy ongoing rate rather than a short-lived introductory rate, and you can’t lose.

Can you cut costs?

Chances are, there’s a handful of regular bills wolfing down your pay packet. Were you guilty of adding on a few too many streaming services during lockdown? Maybe you can look at whether or not you can get a better deal, or maybe give a particular service the flick.

There are many simple steps you can take to reduce your expenses. Big ticket items like your home loan are where the big savings are, but even small savings can add up.

Can you earn more?

Don’t neglect your income. When it comes to making extra cash, the sharing economy offers plenty of opportunities. You might decide to rent out your spare room, share your car or pet-sit to boost the money coming in.

Love thy Super

There is a large gap between the superannuation savings of Australian men and women. Given that women tend to live longer it’s even more important for us to make sure we have a comfy retirement. One way to find out how you are tracking is to use the online Super Balance Detective on the SuperGuru website.

Enter your date of birth, and the calculator shows how much you need in super today to reach the ASFA Comfortable Standard balance by age 67. It shows that a 35-year-old should currently have about $93,000 in super.

Otherwise, jump onto the Retirement Planner on the MoneySmart website. It shows you’re likely income in retirement based on your super balance plus any Age Pension payments. Whichever option you use, if your balance seems a little lean, it’s never too late to grow your super through salary sacrifice, voluntary contributions or government co-contributions. It can make a tremendous difference.

Let’s say a woman aged 35 earns $50,000 annually and has the average super balance for a woman her age of $69,300. By adding just $1 extra to her super each day – that’s $30 a month, and she can accumulate an additional $148,389 in super by age 67.

Head to Moneysmart’s online super calculator to see how a few extra dollars added to your super can make a difference.

There are ways you can boost your super even if you’re not working. Cashback sites like Super-Rewards pay you cashback directly into your super fund just by shopping on their platform.

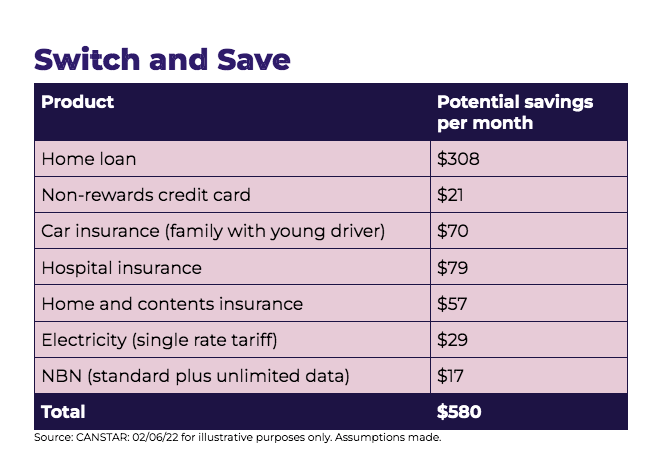

How to save $580 per month

One of the easiest ways to claw back some savings is to take a look at your regular household bills – you could save as much as $580 per week by switching from average payments to the cheapest in the market. Whilst the cheapest may not always be the best it does give you a good idea of how much savings can be made by regularly reviewing your household bills.

Top budget tips and money rules to live by:

It’s not what you earn that counts; it’s what you spend!

When you get a pay rise, sometimes it is a case of the more you earn, the more you spend, which then leads us to spend more on products and services, in turn forcing us to earn even more. It’s a vicious cycle that most of us don’t even realise we are in.

Detox your finances

Just like an organised home has a place for everything, so should every dollar you earn. The bucket system is a simple strategy to help tidy up your finances. There’s no shortage of budget formulas to follow, and a popular option is the 70:20:10 plan. Another is the 60:40 budget plan.

Set your savings to autopilot

Pay yourself first. Set up regular automatic direct debits from your everyday account into your savings. Time the transfers to coincide with paydays. Always treat savings as a bill – it cannot be missed!

Budgets aren’t set in stone

Some people don’t budget and are financially successful, while others watch every cent yet, because of their circumstances, continue to live from pay to pay. If you’re going to do a budget, you’ve got to be honest with yourself about all those hairdresser appointments. There’s no point in making a budget that doesn’t reflect your life.

If you are going to follow a budget, it’s important you have an emergency fund attached to it. Otherwise, you set yourself up for failure.

Work out what makes you tick

Why are some people better savers than others? How do advertisers trick us with “mid-priced” options? Understanding your financial psychology could save you money. Take the time to find out why you do what you do.

Don’t spend mindlessly

Sleep on all impulse purchases for at least one night.

Identify your financial stressors and make a plan

Try not to overwhelm yourself. Make a list of all the money woes you’re having and focus on managing one issue at a time so as to not become overwhelmed.

Keep creditors in the loop

Call your creditors if you are experiencing financial hardship and let them know how you intend to tackle the issues. Many companies have hardship officers who can assess your situation and work out what help and strategy is available.

Build a cash cushion

A cash cushion is finance strictly for emergencies only. Think the loss of a job, medical illness or an unexpected financial curveball.

The idea is you have enough money in your cushion account to not only handle the crisis but, in the event of a job loss, cover your absolute essentials (food, shelter, clothing – designer shoes don’t count) until you find a job again. You should aim to have a few thousand dollars in there to support you through this period.

It can take a while to build up a cushion account, and if you have a mortgage, it may pay to keep your savings there. For example, you have a $400,000 mortgage at 3.37%, and you can afford to save $50 per week. Popping this into your home loan’s redraw or offset facility, you’ll not only have $36,000 in the account after 15 years, but according to Canstar analysis, you’ll save around $10,700 in interest on your home loan.

Seek help

If you don’t know where to start, call the free National Debt Helpline on 1800 007 007. National Debt Helpline is a not-for-profit service that helps people tackle their debt problems. We’re not a lender, and we don’t ‘sell’ anything or make money from you. Our professional financial counsellors offer a free, independent and confidential service.

For more great family budget tips, check out The Healthy Mummy Budget Hub your go-to for budget-friendly tips, tricks and offers from The Healthy Mummy Budget Squad.