Expert Tips To Stop Money Problems Ruining Your Relationship

Money can’t buy you love, but it can cause many problems for couples. In fact, it’s one of the main reasons for relationship breakdowns. One financial planning expert says getting your financial house in order could be just as much a symbol of love as flowers and chocolates.

Deakin Business School’s financial planning expert Associate Professor Adrian Raftery said money plays an important part in relationships. But not always in a good way.

“It is often the main reason for relationship breakdowns,” he says.

“So, while it might not sound very romantic, ensuring joint finances are in order is one of the keys to a happy, long lasting relationship.”

Here are 6 golden money rules for couples looking to keep the romance alive.

6 Golden Money Rules For Couples

1. No Secret Purchases

Associate Professor Raftery says no matter whether you are in a new relationship or have been married for 30 years, communication is the key factor to a great relationship, particularly with money matters.

“There should be no secret purchases or silent credit cards and loans. All finance decisions should be consulted jointly before they are made,” he says.

“Failure to communicate openly and in a timely manner is like a hand grenade it will blow up in your face.”

2. Set Realistic Goals

Couples should also write down their financial goals. This means you have something to work towards and it’s important to know what each other wants.

“Ranking them gives them importance and will give you a master plan to work towards for years to come,” he says.

3. Make A Budget

The financial planning expert says couples should always make sure that they have their bills paid before doing anything else.

He suggests using Excel to do a budget and work out the amount that you need to put aside each month for your expenses.

“Open four online bank accounts for different savings – such as house deposit, holidays, “rainy days” and perhaps a wedding,” he says.

4. Consider A Pre-nupital Agreement

Some may say that this defeats the purpose of marrying based on the values of love and trust.

However, Associate Professor Raftery says a pre-nup is a good preventative measure against a bag egg.

“Love hurts but divorce can cost,” he says.

5. Share Financial Responsibilities

While it might be easier for one person to be in charge of all the financial responsibilities, Associate Professor Raftery warn against it.

“This is particularly important in long-term relationships,” he says.

“I have seen many widows/widowers who do not have a clue when it comes to finances and they have to fend for themselves.”

6. Don’t Commit If Things Are Rocky

Finally, making financial commitments like buying a house are big decisions to make.

If a relationship is rocky then it’s best not to commit to massive debts with your partner says Associate Professor Raftery.

“There are lots of costs and hassles should the relationship end,” he says.

“If you are in a new relationship, don’t leave yourself financially vulnerable by having any of your partner’s debts in your name only.”

Meanwhile, here are 15 ways you can save money on your weekly grocery shop.

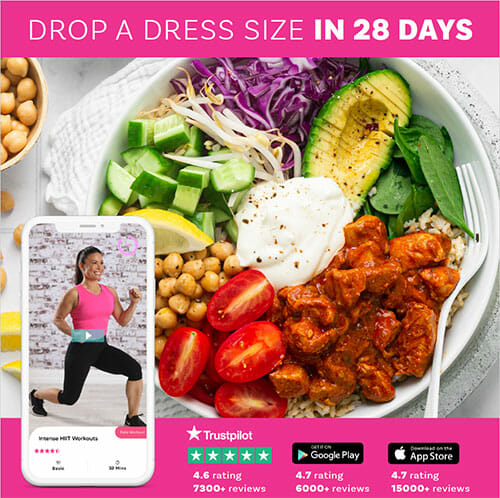

Ready to Drop a Dress Size in 28 Days?

Never Go Hungry

Our program offers NO 1200 calorie restrictions

Workout at Home

Follow guided training videos with expert fitness instructors (no equipment needed!)

Feel Supported 24/7

In our private support groups with other mums just like you!

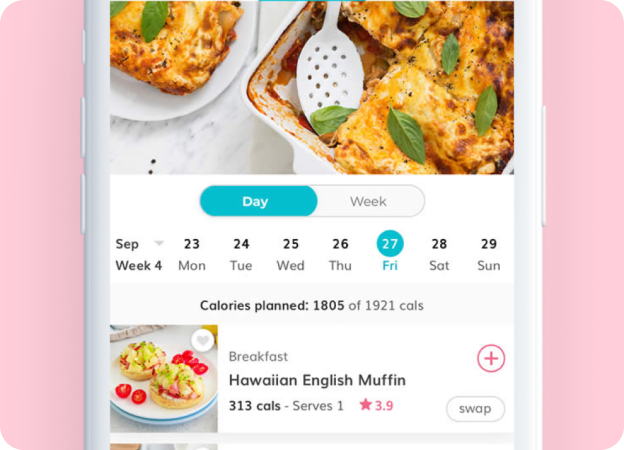

Eat Delicious and Healthy Food

With family-friendly, weekly meal plans & over 6,000 easy recipes developed by nutritionists

No lock-in contracts, cancel anytime.