You’re pregnant, now what? Expert tips to help you prepare financially for a baby

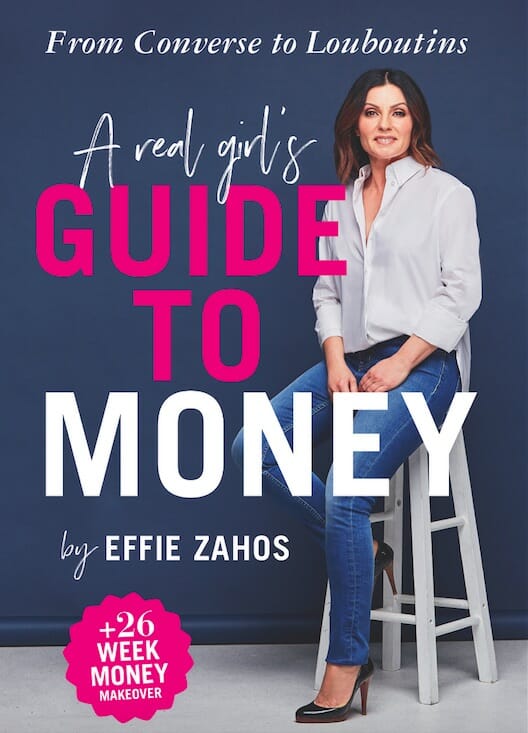

Money expert Effie Zahos offers her advice on how to prepare financially for a baby to ensure you don't get overwhelmed.

Have you just found out you’re pregnant and aren’t sure how you are going to pay for all the things that come along with baby? Or perhaps you are planning to get pregnant and just want to make sure your finances are in order.

Effie Zahos is here to help, as one of Australia’s leading personal finance commentators she certainly knows how to make a budget work for you and as a mum of two she understands the costs of caring for your kids.

In her new book, A Real Girl’s Guide to Money: From Converse to Louboutins Effie offers tips to help you make sure you are prepared for baby from making a list of expenses to preparing to live off one income. Below we share some of Effie’s top tips from her book to help you prepare for the impending arrival.

How to prepare for baby, tips from a finance expert

Make a list of expenses

There are many expenses that come with having a baby so before you go about working up a budget or start buying things make a list of everything that you will need money for from the delivery to diapers.

- Private or public: There are a lot of doctors appointments and checkups that you will need to get during the pregnancy which will add up so you need to consider these costs and also the costs associated with delivery. Effie says, “The choice between going private or public is a personal one. If you are going to opt for a private obstetrician, though, make sure you understand all the costs involved with that and what, if anything, private health insurance may cover.”

- Baby gear: From diapers to clothes to toys to beds to car seats to diapers to prams to bottles did we mention diapers? There is a lot of stuff you need when you are planning for a baby. There is often this urge to just rush out to the shops and buy everything brand new because your baby deserves it right but before you do this consider if you can afford this. Effie offers this advice, “there are ways to get ready [for the baby] on the cheap – you don’t have to buy the most expensive items in the store. Buy second-hand or borrow from friends who’ve recently had babies.”

- Larger expenses: With the new baby do you need to upgrade your car? Renovate your home or move to a larger place? These are big expenses that you need to make sure you have planned for before the bub arrives. Effie does share a silver lining however saying, “The good news is that many of your old expenses will change – if not disappear altogether. All-night dinner parties, spur-of-the-moment getaways, ridiculously expensive but absolutely essential high heels – they’re all likely to become distant memories for a while.”

- Make a new budget: With all the expenses laid out in front of you it would be best to write up a new family budget that takes into consideration the new arrival, whether this is your first bub or fifth you should make sure that you have it all laid out and are prepared as much as you can be before the arrival.

Effie does have one tip that she puts above the rest when it comes to preparing for a baby,

“If you only do one thing while you are pregnant, practise living on one salary, even if for most of the time you have two. This will get you into the habit of being thrifty and hopefully help to pay even more off your home so you have a large buffer for emergencies.”

What money will be coming in?

One way to help you prepare for the financial expenses that come from having a baby Effie says is to make sure you are aware of the money that will be coming in so you can then make sure you have enough to cover what will be going out. She says working out what money you’ll have coming in, “may help you work out how long you can comfortably afford to take off work.”

Effie suggests you check what you are entitled to from the below:

- Parental leave offered by your employer: She notes, “Many larger organisations offer paid parental leave while smaller employers may not have a paid option.” Make sure to check your contract and even chat to HR about what they offer and if there are any conditions that can apply.

- Government assistance: “Remember, too, plenty of financial help is available.” From government funded Parental Leave Pay to Newborn Upfront Payment, Newborn Supplement. There is also Dad and Partner Pay and the Family Tax Benefit, make sure to do your research and see what assistance you are eligible from the government.

Get your affairs in order

This may be something often overlooked in all the celebration and joy of getting ready for a new baby but you need to make sure that if anything were to happen you have plans in place. The key things Effie points out are integral to making sure the baby is looked after are:

- Your will: Effie points out that you will need to update your will to reflect your new situation and if you don’t already have a will definitely get one done. As part of this, she points out that, “One of the nail-biting decisions you’ll need to make is choosing a guardian to take care of your child and manage your assets in case you and your partner die. Think about who will be up to the task – for example, elderly family members may struggle. Also have a chat to them so it doesn’t come as a complete surprise!”

- Superannuation: Effie says, “Make sure you also get a binding nomination for your super as well, as this won’t be handled with the rest of your estate.” Also, remember that superannuation isn’t paid on parental leave payments so you will need to be aware of this also.

- Insurance: This is a must according to Effie, especially life insurance for you and your partner as it ensures your family can take care of living costs if the worst were to happen. Another insurance that needs to be considered is private health insurance, make sure to add the baby to your policy and your Medicare card as soon as possible after it is born.

So there you have it Effie’s advice on how you can best prepare yourself for baby when you discover you are pregnant. If you want more tips and advice like this you should pick up Effie’s new book A Real Girl’s Guide to Money: From Converse to Louboutins available now!

Effie Zahos is one of Australia’s leading personal finance commentators. As editor of Money, Australia’s longest running personal finance magazine, she has a knack for making money matters simple. She is also a regular money expert on Channel 9’s Today show and on radio around Australia. She is a married mum of two reformed spenders, who were helped by Effie’s children’s book The Great $20 Adventure.

Don’t forget to nourish your body during pregnancy with our Healthy Mummy Pregnancy Smoothie

The Healthy Mummy Pregnancy Smoothie is designed to complement, not replace, your prenatal vitamin intake. Our nutritionists ensured that the vitamins and minerals in the smoothie are at a low level so there is no risk of doubling up on any pregnancy vitamins.

It is ideal as a high-protein, high-calcium snack in pregnancy. You can download the Pregnancy Smoothie Label here.

To purchase yours, click here.

Also if you want support and advice from mums going through pregnancy join our Pregnancy Support Group.

*Please note that The Healthy Mummy Pregnancy range promotes healthy weight gain in pregnancy*