Healthy Mummy Articles

Check out the latest Healthy Mummy articles and get recipes and stories to help mums lose weight, get healthy and change their life.

Meet Our Community Mums: Real Stories, Real Inspiration!

Here at The Healthy Mummy, we’re all about celebrating YOU – our incredible community! Nothing motivates us more than hearing how The Healthy Mummy has truly transformed lives, not just through numbers on a scale, but by empowering mums to…

How to prepare for the Next 28 Day Weight Loss Challenge

Are you starting the next 28 Day Weight Loss Challenge? Here's how to prepare so you can SMASH Your GOALS!

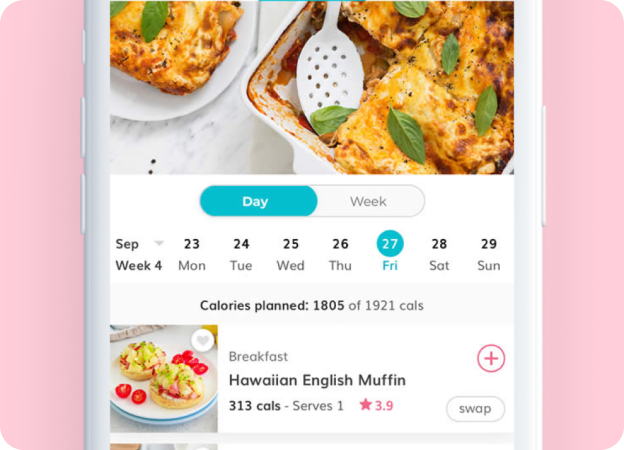

Slow Cooked Lasagne Soup

Craving the comforting flavours of lasagne but want a quick and easy alternative? Look no further than this delicious lasagne soup recipe.

Seasonal & Savvy! Immune Support Tips for Your Wallet

As the calendar pages turn and the days grow shorter, winter has undeniably settled in, bringing with it not only a refreshing crispness in the air and a noticeable dip in temperatures but also the inevitable arrival of those unpleasant…

Sneak peek: your July “Winter” 28 Day Weight Loss Challenge!

Don’t let the winter chill put your goals on hold! The Healthy Mummy Winter 28 Day Challenge is here to keep you on track, focusing on delicious, winter warming and family friendly recipes. July 2025 is all about embracing the…

12 reasons why Wall Pilates is good for you

Wall Pilates - the new craze and why it is great!

REVEALED! Experts have found out the age when you have the BEST SEX of your life!

Thought those carefree sexual encounters in your twenties were the peak of your sex life? Well, you’re actually wrong your best sex comes later in life.

9 Quick and Easy Warming Winter Soups you MUST TRY!

These deliciously satisfying soups from the 28 Day Weight Loss Challenge, are perfect to a feed a large family on a cold night, or as a quick grab and go lunch from the freezer when you've got no time.

9 Easy Ways to Lose Tummy Fat in Winter

With the colder months of winter now upon us, the prospect of losing weight and blasting away tummy fat can seem a lot more challenging. Tummy fat is notoriously one of the most troublesome areas of fats for lots of…

Everything you need to know about Wall Pilates

Wall Pilates is designed for maximum fat-burning & muscle toning, utilising only your body & the wall as your gym. It’s so low maintenance you could even do it in the staff room on your lunch break. Wall Pilates is…

Introducing our brand NEW 28 Day Gut Health Meal Plan!

Our Gut Health Meal Plan will help you feel healthy from the inside out.

Wheat-free apple and cinnamon oat loaf

If you are trying to cut down on wheat, have run out of flour, or just want to try something different, this sweet loaf made with homemade oat flour is perfect. Serve this for afternoon tea and both you and the…

8 YUMMY Winter Recipes The Kids Will LOVE!

Want something to do with your kids when it’s cold outside? Why not get them involved with the meal prep for these fun and healthy kid friendly meals? All of these amazing recipes come from The Healthy Mummy App and are healthy,…

What happens to your vagina as you age or lose weight

Discover what happens to your vagina as you age, or lose weight, whether you notice it or not.

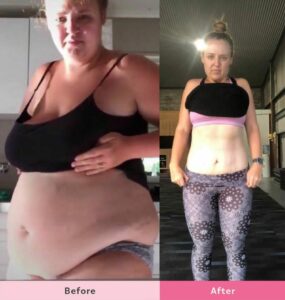

Tanya has lost 43kg with The Healthy Mummy

Tanya has been with The Healthy Mummy for over 6 years and is proud to share her 43kg weight loss story to help motivate other mums. Tanya tells The Healthy Mummy, “I started with The Healthy Mummy in November 1st…