News

Stay up to date with all the latest news, reviews and information with The Healthy Mummy news blogs. From product launches to celebrations we have you covered.

Expert Tips To Stop Money Problems Ruining Your Relationship

Money can’t buy you love, but it can cause many problems for couples. In fact, it’s one of the…

1 in 4 parents still think smacking is necessary

“Do you want a smack?!” This has been a common refrain from many parents across history. Right along with…

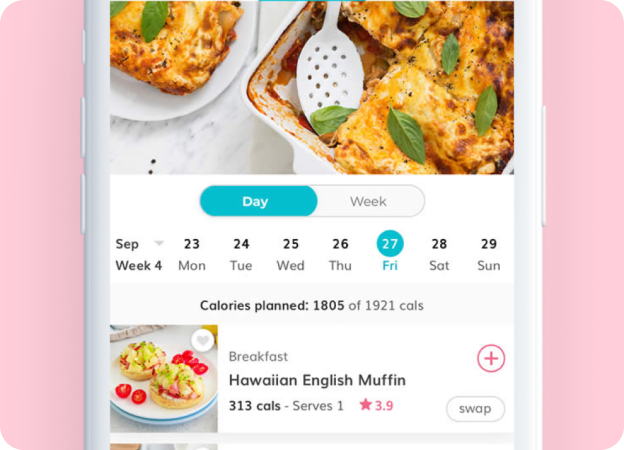

Say what? $50 for a week’s worth of dinners for a family of 4!

As seen on The Morning Show, Sascha cooks up simple, healthy and budget friendly dinners that your family will love.

Top foods to reduce stomach fat and bloating

If you're sick of seeing that belly bloat or tummy flab check out our tips to help you reduce stomach fat and bloating whilst staying healthy and happy.

6 tips to save money as the kids head back to school in 2024

As we near the start of Term 1 for 2024 many kids are excited to start the new year…

The best Christmas ham according to the experts

CHOICE have done the hard work for us all and tested out Christmas hams for flavour and affordability. They…

REAL mums celebrate their bodies by posing in pink body paint for a gorgeous photoshoot

Aussie mums strip down to their undies to pose in pink body paint to celebrate body positivity. See their amazing photos here.

The Healthy Mummy in Woolworths

The Healthy Mummy Tummy Smoothie is the perfect way to support your health, especially your gut health. Its unique…

Food diary – the secret to your successful weight loss

The thing with a healthy eating plan, like everything in life, you need to constantly reassess and see where you stand and a food diary is a key to this.

Is fat a dirty word?

Fat can be a dirty word, especially when you are trying to lose weight or maintain it. But certain fats are essential to a healthy eating plan.

NEW Product Alert! Mixed Berry Premium Smoothie

Check out our BRAND NEW Mixed Berry Premium Smoothie! It's full of all the goodness in our premium smoothies with a delicious berry flavour!

Pregnancy Smoothie – everything you need to know

Original blend of energising nutrients and anti-nausea ingredients, formulated by expert nutritionists and food technologists.

‘WORLD FIRST BREAKTHROUGH’ – New research by sleep expert whose own child died of SIDS, identifies babies at higher risk of suffering the condition

The new breakthrough study has identified a biochemical marker that could help detect babies more at risk of SIDS, while they are alive.

Jasmine’s incredible weight loss journey: 45 kilos down

Jasmine Ready has had TWO successful weight loss stories with The Healthy Mummy. The Queensland-based mum first lost 39…

NEW PRODUCT ALERT!! Introducing ‘BLOAT’ for a slimmer flatter tummy!

If you suffer from abdominal bloating and discomfort we have the most INCREDIBLE new product available to help you BANISH THE BLOAT!