Healthy Mummy Articles

Check out the latest Healthy Mummy articles and get recipes and stories to help mums lose weight, get healthy and change their life.

Quick and Easy Choc Berry Brownie Bites

These Choc Berry Bites from the 28 Day Weight Loss Challenge are decadent and indulgent but are just 298 calories each.

12 ways to manage food cravings at night

There is nothing more frustrating than sticking to your healthy eating plan during the day and getting caught out by snacking late at night. Late night food cravings and midnight fridge raids can be avoided and with a little awareness and…

Do you and your partner have mis-matched libidos? You’re not the only ones

If you’re in a relationship with someone who wants to ‘get busy’ more than you or vice versa, then don’t despair because you’re not alone. And yes, there are actually solutions – including some you might not have thought about.…

Roasted Pumpkin Soup Recipe

Whether you're a seasoned chef or a kitchen novice, this simple yet flavourful pumpkin soup recipe from The Healthy Mummy will have you cozying up with a bowl of homemade goodness in no time.

11 common mistakes when lifting weights

Avoiding common weight-lifting mistakes is crucial for making progress and preventing injuries. Some of the most common mistakes people make when lifting weights and weight training include: improper form, overtraining, or skipping warm-up and cold down, plus not following correct…

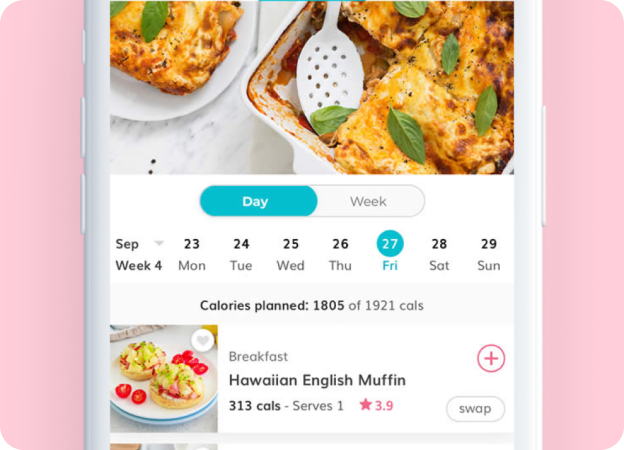

Oven Baked Simple & Healthy Tomato Feta Pasta

The Healthy Mummy App has it's own version of the Baked Simple Tomato and Feta Pasta recipe that's swept social media and it's just 421 calories!

10 Mum’s INSPIRING before and after weight loss results

Prepare to be inspired! 10 real life mums share their INSPIRING weight loss results from The Healthy Mummy 28 Day Weight Loss Challenges. Their transformations are nothing short of SPECTACULAR and proof that The Healthy Mummy’s healthy and balanced approach…

Watch how to PERFECT your Lava Mug Cake every time

It's the Chocolate Lava Microwave Cake from the 28 Day Weight Loss Challenge that the Healthy Mummy community absolutely LOVES!

10 healthy ways to use avocado (besides guacamole)

Try these ten interesting alternate ideas for avocado. Not just great for guacamole, avocado is packed with health benefits

Mum ditches her three daily coffees and the results are astounding!

Healthy Mummy Laura Flanagan was asked if she would try swapping her daily coffee (or three) for other alternatives including our energy-boosting Super Greens and her initial response was a firm no. “As a Mum of three under four with a five month old, non sleeping baby, to…

What are macronutrients? Here’s everything you need to know

Macronutrients (macros) provide the body with energy and they are made up of: carbohydrates, proteins and fats. Three basic components of every diet.

Running to lose weight – here’s what need to know

There’s no doubt that running is a fantastic form of exercise. Here's everything you need to know about it.

Can you drink alcohol and still lose weight?

Are you a social butterfly who loves to have a drink of alcohol with friends? Good news is you still can while blasting belly fat or losing weight. Here is how!

Meet Our Community Mums: Real Stories, Real Inspiration!

Here at The Healthy Mummy, we’re all about celebrating YOU – our incredible community! Nothing motivates us more than hearing how The Healthy Mummy has truly transformed lives, not just through numbers on a scale, but by empowering mums to…

How to prepare for the Next 28 Day Weight Loss Challenge

Are you starting the next 28 Day Weight Loss Challenge? Here's how to prepare so you can SMASH Your GOALS!