Lifestyle

The complete lifestyle blog for women. Real mum stories from our Healthy Mummy Community, plus fashion, beauty and celebrity news. For The Healthy Mummy with a little down time. We share holiday and travel information for travelling with little ones, plus promotions and giveaways we know you will love!

Mum ditches her three daily coffees and the results are astounding!

Healthy Mummy Laura Flanagan was asked if she would try swapping her daily coffee (or three) for other alternatives including our energy-boosting Super Greens and…

Meet Our Community Mums: Real Stories, Real Inspiration!

Here at The Healthy Mummy, we’re all about celebrating YOU – our incredible community! Nothing motivates us more than…

REVEALED! Experts have found out the age when you have the BEST SEX of your life!

Thought those carefree sexual encounters in your twenties were the peak of your sex life? Well, you’re actually wrong your best sex comes later in life.

9 Quick and Easy Warming Winter Soups you MUST TRY!

These deliciously satisfying soups from the 28 Day Weight Loss Challenge, are perfect to a feed a large family on a cold night, or as a quick grab and go lunch from the freezer when you've got no time.

Introducing our brand NEW 28 Day Gut Health Meal Plan!

Our Gut Health Meal Plan will help you feel healthy from the inside out.

Eat dumplings to help you lose weight

Dumplings to aid weight loss? Yes, definitely! Your favourite takeaway does not have to be a thing of the…

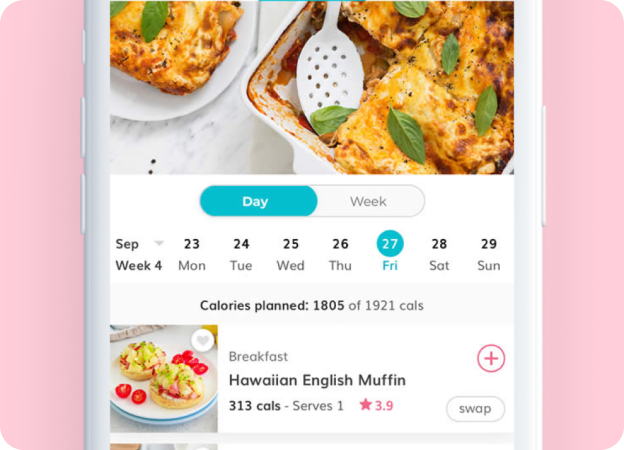

How Many Calories Should I Eat To Lose Weight?

Find out how many calories you need to lose weight with our comprehensive guide. Use our calorie calculator to determine your daily intake and avoid gaining weight. Achieve your weight loss goals effectively!

Cold & Flu Season: Immune System Myths Busted by an Expert Dietitian

We sat down with Moshy's Lead Dietitian, Kirby Sorensen to get the most accurate and up-to-date information, helping us cut through the noise and debunk some common immune system myths you might hear this season.

Expert Tips To Stop Money Problems Ruining Your Relationship

Money can’t buy you love, but it can cause many problems for couples. In fact, it’s one of the…

Strengthen Your Immunity: Key Nutrients to Support a Healthy Immune System

We explore the three key nutrients that are crucial for a strong and healthy immune function: Vitamin C, Vitamin D, and Zinc, and how you can easily include them into your day.

10 ways to lose 4-5kgs this winter

Many people worry about gaining weight gain in the winter - we're less active when it's colder and we tend to eat warm, filling food.

9 Reasons Why Mothers Should ALWAYS Trust Their Instincts

You’ve given birth to your beautiful baby, you’ve signed the discharge papers and you bundle your babe up in a…

The Top 7 Benefits of Working Out with Weights!

Find out why adding weights to your workouts will boost your health and fitness, improve your balance, strengthen your bones and help with weight loss.

Wellness: Move is here!

You may know The Healthy Mummy for our heart-pumping HIIT sessions and muscle-building strength training, but now we’re excited…

Everything you need to know about coeliac disease

We have pulled together a guide on everything you need to know about this disease, including some great coeliac…